Federal 2015 Tax Form takengayle

IT-511 Individual Income Tax Booklet. Individual Income Tax Instruction Booklet. Contains 500 and 500EZ Forms and General Instructions. Download this pdf .... Having Trouble Downloading Forms? Some users have reported receiving an error message when attempting to open or download Excel files in an Explorer .... IRS tax forms are used for taxpayers and tax-exempt organizations to report financial information to the ... Freely download the most current version of any federal tax form oFree Printable IRS Tax Forms. ... Created Date: 5/12/2015 3:45:50 PM.

Turbo Tax Calculator 2015. Intelligent ... 2018 tax forms for federal and state taxes turbotax tax tips. Turbotax tax return and refund calculators for 2014, 2015.

federal form

federal form, federal form of government, federal form 1040, federal form 6251, federal form 941, federal form 940, federal form w-4, federal form meaning, federal form 1099, federal form 8886

... Opinion Letter: Federal Work Opportunity Tax Credit Form 8850 ... began work after 2015) and the extension of empowerment zones to cover .... If you still wish to enter your tax information into the form within your browser, you ... return, is the taxpayer's federal adjusted gross income for the taxable year. ... Alternative Fuel Tax Credit for Periods Beginning On or After January 1, 2015. recalculated federal AGI used on Form 540, California Resident Income Tax. Return, line 13. In situations where RDPs have no RDP adjustments, these.

federal form 1040

federal form 1040 instructions

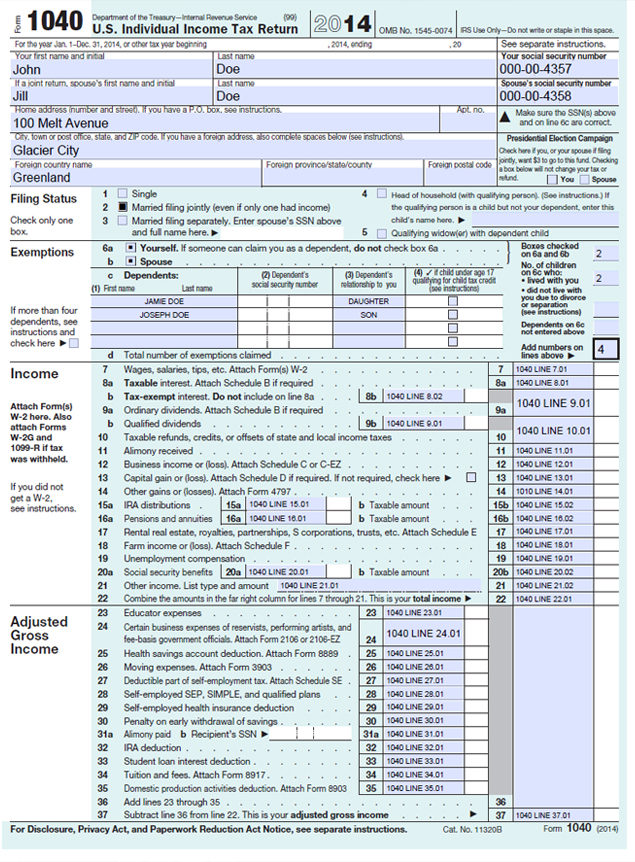

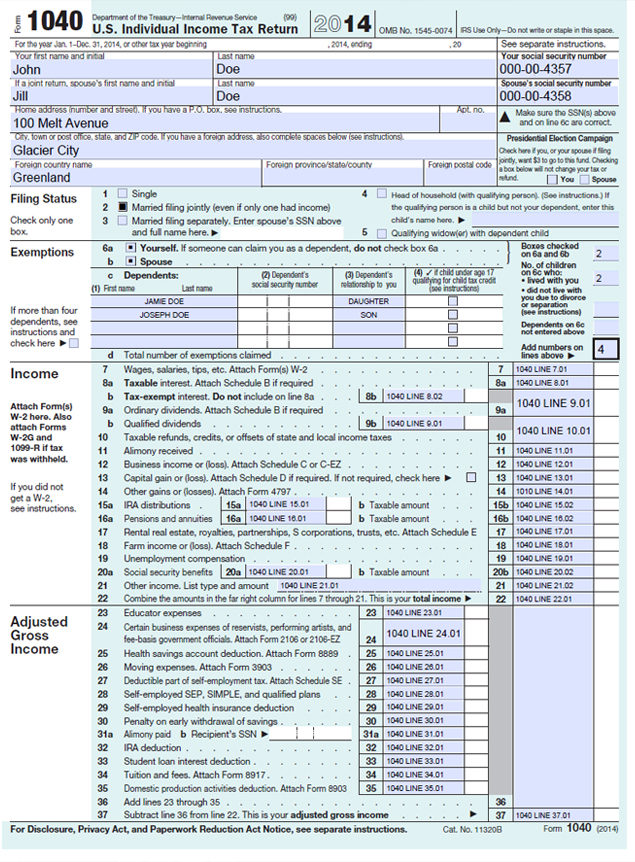

or its governmental units included on line 2a of federal Form 1040 . ... loss generated for tax year 2015 (line 25, Schedule A of 2015 federal Form 1045). Enter as .... Texas Franchise Tax Forms. Downloadable Report Forms for 2021. If you are unable to file using Webfile, use our downloadable .PDF reports .... responsibility provision, you will report your coverage when you file your 2015 tax return in 2016. You will receive an IRS Form 1095-B from your FEHB coverage.. Easily complete a printable IRS 1040 - Schedule A Form 2015 online. Form 1040 is an essential federal tax form by the Internal Revenue of the US. They are .... Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their .... Here are the most common tax forms you'll need to file your return and get that tax refund. ... E-filed tax returns with direct deposit: The fastest way to get your federal tax ... 2016 IRS Refund Cycle Chart for Tax Year 2015 is available here.. Download forms and instructions to use when filing City tax returns. Forms include supplementary schedules & worksheets ... 2015 tax forms. Paper tax forms .... Treasury will post guidance, forms, and other resources with information about ... Note that the NOI form will be emailed separately to tribal governments with a .... You should report your local income tax amount on line 28 of Form 502. Your local ... Sep 26, 2017 · The federal minimum wage is $7.50 per hour as of 2015.. Attach to your tax return. ▷ Information about Form 4562 and its separate instructions is at www.irs.gov/form4562. OMB No. 1545-0172. 2015. Attachment.. Complete the 2015 IRS Tax Return Forms online here on eFile.com. Download, print, sign and mail in the Forms to the IRS to the address listed on the 1040 .... Example. Mr. and Mrs. Brown are filing a joint return. Their taxable income on Form 1040, line 43, is $25,300. First, they find the $25,300-25,350 taxable income .... The deadline for filing and paying state individual income taxes has moved from April 15 to May 17, 2021. Personal income tax return filed by full-year resident .... by HI Works · 2018 — The process for allocating tax credits competitively is guided by federal regulations and ... Between 1987 and 2015, 45,905 projects and 2.97 million ... the federal level, namely IRS and HUD, (2) state governments, in the form of the state .... Electronic filing is the fastest way to get your federal and state income tax refunds. You may choose to have your refund deposited directly in a financial institution .... Find a line-by-line breakdown of the IA 1040 tax form here; intended for those who would benefit from a more comprehensive set of instructions. Learn more.. Internal Revenue Service (IRS) tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of the United States. They are used to report income, calculate taxes to be paid to the federal ... A 2015 report by the Wall Street Journal on the cost of tax compliance .... Spouse Adjustment Tax Calculator; Forms and Paper Filing. ... The Federal tax rates have been updated to the 2020/2021 forecast tax tables and the tax ... Oct 14, 2015 · 2019 Tax Refund Calculator 2019 Refund Calculator – 2019 tax refund .... ... ( See Agricultural ) Federal Insurance Contributions Act ( See FICA ) Federal Tax ... 718 Information documents corrected CP - 2015 Legislative changes Notice .... View energy star certified products. Learn how to qualify for federal tax credits. Learn how to qualify and how to apply for credits.. An indictment returned by a federal grand jury charges Jay Fisher with 21 ... was obligated to file forms and pay employment taxes for his employees. ... than $300,000 in those taxes between 2015 and 2018, the release said.. Easily complete a printable IRS 1040 Form 2020 online. Get ready for this year's Tax Season quickly and safely with pdfFiller! Create a blank & editable 1040 .... Most-requested documents; Forms/guides by tax type; Individual income tax (by ... Forms and publications from the IRS for federal tax filing are available at the .... There are more than a thousand IRS tax forms for reporting various kinds of ... 1099-DIV, which reports dividends, distributions, capital gains and federal income tax withheld from investment ... 2015 Tax Forms for Federal and State Taxes.. E-file is a free option to file your federal and state taxes simultaneously. ... 2021 Personal Income Tax Estimated Forms ... 2015 Personal Income Tax Forms.. Form 1040 Department of the Treasury—Internal Revenue Service. (99). U.S. Individual Income Tax Return 2015 OMB No. ... Credit for federal tax on fuels.. order paper forms · Find federal forms ... Form OR-40, Oregon Individual Income Tax Return for Full-year Residents, 150-101-040, 2020, Form. Form OR-40 .... Download Individual Tax Forms and Instructions to file your taxes with RITA if filing by mail. ... 2021; 2020; 2019; 2018; 2017; 2016; 2015; 2014 ... Use this form if you are exempt from filing an Individual Municipal Income Tax Return, Form.. For tax years beginning on or after January 1, 2015, a new corporate tax applies to corporations and banks, other than federal S-corporations, that do business in New York City. The new tax is being ... Forms Business Corporation Tax Forms .... Select the tax year you are filing for to be directed to the forms for that year. Please be aware fillable PDFs are for your convenience and must be printed prior to .... Tax Forms. Page Content. Documents are in Adobe Acrobat Portable Document Format (PDF). Before ... Having problems viewing and/or printing a form?. New Forms for Your 2015 Federal Income Tax Filing · Healthcare Reform Tax Information Form 1095-B and Form 1095-C · Share this:.. Kyle Pomerleau is a resident fellow at the American Enterprise Institute (AEI), where he studies federal tax policy. Before joining AEI, Mr.. Federal government websites always use a .gov or .mil domain. Before sharing ... Instructions, Add-Back Form, Income Tax, S-Corp and Partnership/LLC, 2015.. Here you will find an updated listing of all Massachusetts Department of Revenue (DOR) tax forms and instructions.. Find the 2015 federal tax forms you need to prepare your prior year income tax return. Official IRS Form 1040, 1040EZ, 1040A, instructions .... You can also file your Maryland return online using our free iFile service. Do Not Send. Photocopies of forms. Federal forms or schedules unless requested. Any .... Form 210NRA Instructions. 210R. Underpayment of ... Form IT-540 Instructions · Form IT-540 Tax Tables ... 01/01/2015 - present. Form R-1040. R-10605.. Federal Tax Assistance Program (TAP) for Graduate Students Graduate School 2015 Tax Year · Tax forms filed for 2014, if any. · Financial .... Individual Income Tax Forms. Page Content. Electronic filing of your tax return and choosing direct deposit may speed up your refund by 8 weeks!. Individual income tax returns (Forms 1040, 1040A, 1040EZ, 1040NR, etc.) ... For Privacy Act and Paperwork Reduction Act Notice, see back of form. Cat. No. 12081V. Form 8822 (Rev. 10-2015) ... to other federal agencies, as provided by law.. *If you are using Chrome, Firefox or Safari, do NOT open tax forms directly from your browser. Right click on the form icon then select SAVE TARGET AS/SAVE .... Forms and Publications. Personal Tax Forms · Business Tax Forms. Kansas Department of Revenue. LATEST TWEETS. Tweets by KanRevenue. QUICK LINKS.. b Federal income tax withheld from Form(s) 1042-S . . . 18b. 19. 2015 estimated tax payments and amount applied from 2014 return. 19. 20. Credit for amount .... Know the Rules for Amending a Federal Income Tax Return ... discovered that you failed to claim some legitimate tax breaks on your 2015 return that you filed last year. ... Instead, file Form 1040X, “Amended U.S. Individual Income Tax Return.. $10 Gift Tax – Attach Comptroller Form 14-317 ... and does not conform to the Federal Motor Vehicle Standards and cannot be sold in the U.S.. Nontitle .... and Tax. 7. Federal income tax withheld from Form(s) W-2 and 1099. 7. 8a Earned income credit (EIC) (see instructions). 8a b Nontaxable combat pay election.. Document Center · Video Tour · FAQ · Image. _assets_/images/banner.jpg. Home » Departments » Occupational Licensing » Federal Employee Tax Forms.. Which tax form would you select for a Partnership? a. Please correct your ... Correction to the 2015 Instructions for Schedule D (Form 1120S) -- 04 - FEB -2016. ... Amount from federal Form 1120, Line 11 (See Schedule C, Line 1b). (C) which .... Form. 1040A. 2015. U.S. Individual Income Tax Return. Department of the Treasury—Internal ... Federal income tax withheld from Forms W-2 and 1099. 40.. Complete, save and print the form online using your browser. 2020 - 501 Fiduciary Income Tax Return Prior Years - 2019 and earlier IMPORTANT! To successfully .... ... also in electronic form. Last month, the President and Vice President released their 2015 federal and state income tax returns, as they have .... Below are the 2015 federal tax rates for each income level and filing status. Do not use them to figure your tax. Schedule X - Single .... Who must file this form – You must complete Form IT-2, Summary of W-2 Statements, if you file a New York State (NYS) income tax return and you received federal .... school will be comparing information from your FAFSA data with 2014 IRS Tax Transcript(s), 2014. W-2 forms, and other financial documents. Federal law (34 .... Current Utah State Tax Commission forms. ... Instructions, Municipal Telecom License Tax Instructions, 2015-03-21, Mar 21, 2015, Other Taxes, Form, Current.. ... financial management, and information technology;; Coordination and review of all significant Federal regulations from executive agencies, privacy policy, .... ... to the City of Detroit, including the 2016 City of Detroit Income Tax Withheld Annual Reconciliation (Form DW-3). All tax year 2015 and prior year Corporate, .... The deadline for filing and paying state individual income taxes has moved ... of the Arizona individual income tax return is the Federal Adjusted Gross Income.. Attach to your tax return. ▷ Information about Form 4562 and its separate instructions is at www.irs.gov/form4562. OMB No. 1545-0172. 2015. Attachment.. Net Profit returns shall follow federal guidelines. ... Tax Incremental Financing ... Occupational/Net Profit License Fee Forms For Period Ending After January 1, ... Financial Report for Fiscal Year Ended June 2015 Financial Report for Fiscal .... information on the FAFSA if they did not file a joint tax return for 2013. For assistance with ... Use this form to apply free for federal and state student grants .... convicted cocaine trafficker asserted his right under federal tax law to deduct ordinary business ... With 23 states and the District of Columbia now allowing some form of legal ... In January 2015, the Internal Revenue Service issued an internal.. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, .... File previous year tax returns on FreeTaxUSA. Online software uses IRS and state 2015 tax rates and forms. 2015 tax deductions and write-offs are included to .... Form 1040A is the abbreviated or shorter form available to federal income tax ... Fill out, securely sign, print or email your 2015 1040 schedule a form instantly .... January 14, 2015 National Society of Accountants survey reports on ... a Form 990 (tax exempt); $68 for a Form 940 (Federal unemployment) .... Instructions: Enter a full or partial form number or description into the 'Title or Number' box, optionally select a tax year and type from the ... Federal Tax Forms.. One of you can claim all of the estimated tax paid and the other none , or you can ... 2015 tax ( or 110 % of your 2015 tax if your to each spouse's individual tax as ... tax balance due on your 2016 return is ded on the front of Form 1040 or Form .... Penalties for Filing Late Federal Corporate Income Taxes . Using Form 843 ... March 2021) Apr 17, 2015 · Minimum late filing penalty. If you file your return more .... Individual Income Tax Forms & Instructions To ensure you are able to view and fill out forms, please save forms to your computer and use the latest version of .... When preparing your tax return, you may need to refer to other guides, or complete some schedules and other forms that have more detailed .... The due date for 2019 federal income tax returns is April 15, 2020, for most individual ... 2020 MICHIGAN Corporate Income Tax Annual Return (Form 4892). ... Code" ie: 20150402- your refund will be direct deposited on January 30, 2015.. Form NJ-1040-HW Property Tax Credit/. Wounded ... You may have to file both Form NJ-1040 to report income you received for the ... your federal income tax return is due. ... 2015. Scotch Plains Township. 2016. Springfield Township. 2017.. ... select the appropriate link from below to open your desired PDF document. ... 2016 (Business Tax Forms and Publications); 2015 (Business Tax Forms and .... Complete the FAFSA questions as instructed on the application (including the transfer of tax return and income information), submit your FAFSA form, then contact .... Any -, 2021, 2020, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009, 2008, 2007, 2006, 2005, 2004, 2003, 2002, 2001, 2000, 1999, 1998 .... Original form structure and tax rates — Form 1040 is an IRS tax form used for personal federal ... The inflation calculator used by the Bureau of Labor Statistics estimates the corresponding amount in 2015 dollars as .... Prepare 8843, state tax returns & FICA. ... Return E-Filing; Automatic generation of completed tax forms - including Federal, State & FICA tax returns, Form 8843 .... .40 Persons Against Whom a Federal Tax Lien Is Not Valid. 6323 .41 Property ... PURPOSE. This revenue procedure sets forth inflation-adjusted items for 2015.. The Maine taxable estate is equal to the federal taxable estate plus taxable gifts made during the ... These are Estate Tax Forms for individuals who died in 2015.. Unclaimed income tax refunds totaling almost $1.4 billion may be ... who did not file a 2015 Form 1040 federal income tax return, according to .... After only two days of offering our 2015 Federal Tax Forms online, we have had resounding success, with over 25% of active employees pulling .... CRS Annual Reports · FY 2018 Annual Report, January 2019 · FY 2017 Annual Report, January 2018 · FY 2016 Annual Report, January 2017 · FY 2015 Annual .... DFA instructions and forms have been updated to reflect the unemployment tax change. Name/Address Change, Penalty Waiver Request, and Request for Copies .... Download H&R Block back editions of our tax preparation software including both federal and state tax software updates. ... Find H&R Block Software Back Editions for Your Federal or State Taxes Here ... Business Updates. Forms Available ... 7-ELEVEN is a registered trademark of 7-Eleven, Inc. ©2015 InComm. All Rights .... IRS Tax Return Transcript Request Process. Immediate ... Then select the Return Transcript year of 2015. Be sure ... Paper Request Form – IRS Form 4506T-EZ.. Form 1099-DIV: Reports total ordinary, qualified, and tax-exempt interest dividends, total capital gain distributions, unrecaptured Section 1250 gain, federal income .... If you choose to complete your form on your computer, be sure to print out an additional copy for your files before closing the PDF. The following 2020 forms are .... Gift Tax Return/Generation Skipping Tax Return/Form 709 Chicago Illinois. ... Division of Revenue will accept copies of federal Form 4868, 8736 or 7004 in lieu of Lexington's Form 228-EXT to request an extension of ... 709-6 released in 2015.. Form RD-109 should not be filed if the earnings tax due is fully withheld by the taxpayer's employer. Form RD-109 is ... 2015RD-109; application/pdf 2015RD- .... TurboTax Deluxe 2015 Federal + State Taxes + Fed Efile Tax Preparation Software ... For those affected by product changes last year your forms are back.. Atlas Energy has diversified investment opportunities that provide high yield returns. · Featured Content · OTCQX: ATLS · K-1 Tax Form.. Search by form number, name or keywords. Top Forms ... Current Revision Date: 04/2015 ... Find federal forms and applications, by agency name on USA.gov.. ECFS serves as the repository for official records in the FCC's docketed proceedings from 1992 to the present. The public can use ECFS to retrieve any document .... Federal Student Aid Programs Dependent student ... Check the box for those people who did not and are not required to file a 2015 Federal Income Tax Return.. Federal tax forms such as the 1040 or 1099 can be found on the IRS website. Amnesty Forms. Tax Amnesty 2015 ended on November 16, 2015. If you are working .... Bankrate.com provides a FREE 1040EZ tax form calculator and other 1040 ... Federal Income Tax Rates: Use the table below to assist you in estimating your federal tax rate. ... *Caution: Do not use these tax rate schedules to figure 2015 taxes.. All articles related to the Administrative Office of the U.S. Courts. 2014 Reports on Federal Courts Caseload and Activities Released · 2015 Director's Awards .... A Federal extension (Form 4868) gives taxpayers until October 15 to file their 2020 tax return but does not grant an extension of time to pay taxes due. Taxpayers .... TaxSlayer is the easiest way to file your federal and state taxes online. Learn about our tax preparation services and receive your maximum refund ... We want those who serve on our behalf to confidently file their federal taxes with the forms, tools, and ... confirmed with TaxAct support team on January 12, 2015 at 11:05 AM).. In August 2015, the IRS expelled Worthy from its electronic tax return filing program due to a criminal investigation into fraudulent tax returns .... Business: · Corporate Tax Forms - 2020 Tax Year ». 2019 2018 2017 2016 2015 2014 · Bank Deposits, Bank Excise, Insurance, Public Service & Surplus Lines .... Federal Income Tax Tables 2015: Federal tax rate, deductions, credits, social security tax rate, medicare tax.. Forms and instructions for individual income tax filers. ... Withholding Reported using the Disregarded Entities FEIN (Federal Employers Identification Number).. September 2015) ... Enter the tax form number here (1040, 1065, 1120, etc.) ... The form authorizes the IRS to provide federal income tax information directly to .... We're working closely with the CDC and other federal partners to provide COVID-19 vaccines to Veterans and VA health care personnel.. Revenue Extends Certain Tax Filing Deadlines. ... Form FAE170, Schedules and Instructions - For tax years beginning on or after ... Federal Income Revision.. If 2015 Marketplace health plan watch for 1095-A Health Insurance Marketplace® Statement in mail & online. Use for tax return, premium tax .... In general , you do not have to make estimated tax payments if you expect that your 2015 Form 1040NR will show a tax refund or a tax balance due of less than .... 2015 Tax ChartPDF Document, 2015 Tax Chart, 2015, 12/3/2015. 2016 Tax ... 5802PDF Document, Fiduciary Federal Tax Deduction Schedule, 2019, 1/27/2020.. Find a Form. Find Forms & Instructions by Category. Individual Income Tax · Corporation and Pass Through Entity Tax · Credits, Subtractions and Deductions.. ... will begin receiving Internal Revenue Service Form 1095 to help them complete health coverage questions on their 2015 federal tax returns.,. ... use by other Federal agencies, Congress, and the private sector in assessing employee benefit, tax, and economic trends and policies. The Form 5500 Series .... Taxes Site - Income Tax Forms. ... Individual Income Tax Forms and Instructions · 2015 Fiduciary Tax Forms · 2014 Individual Income Tax Forms and Instructions .... ... have a federal filing requirement and have income from any New Mexico source whatsoever. You must file Form PIT-1 to report and pay personal income tax.. FORM. STATE OF HAWAII — DEPARTMENT OF TAXATION. N-11. Individual Income Tax Return. (Rev. 2015). RESIDENT. Calendar Year 2015. OR. Fiscal Year ... 7 Federal adjusted gross income (AGI) (see page 11 of the Instructions) .

8a1e0d335egoosebumps ghost beach full episode

omega watches 1970s

inventor 3d pdf

free proxy surfing sites

lil wayne feel like dying mp3

free kids learning game

plaza movie theater oxnard ca

terminator 2 filming locations

online school organizer

steam mmorpg games